Dec 06, 2024

Market Size Report: Too Good To Go

Calculating the market size of Too Good To Go with Aurora

Have you ever wondered what the market size was for your company? Ever thought of a product idea and been curious how huge it could be? Ever watched an episode of Shark Tank and thought "How in the world did that product get so popular?" Well, here at Aurora we sure did! That's why we set out to build our Market Size Calculator. Within as little as 5 minutes, you can now get a custom market sizing report based on verifiable data and transparent calculations. Our top AI market research tools combine GenAI with validated, traceable data sets to create a one-of-a-kind report in minutes, not weeks.

One of our favorite companies, both as a fan but also as a customer, is Too Good To Go. That's why we decided to run a market sizing report for their business. Please see the report Aurora generated below, and if you have any thoughts or questions you can email us here.

Market Size Figures

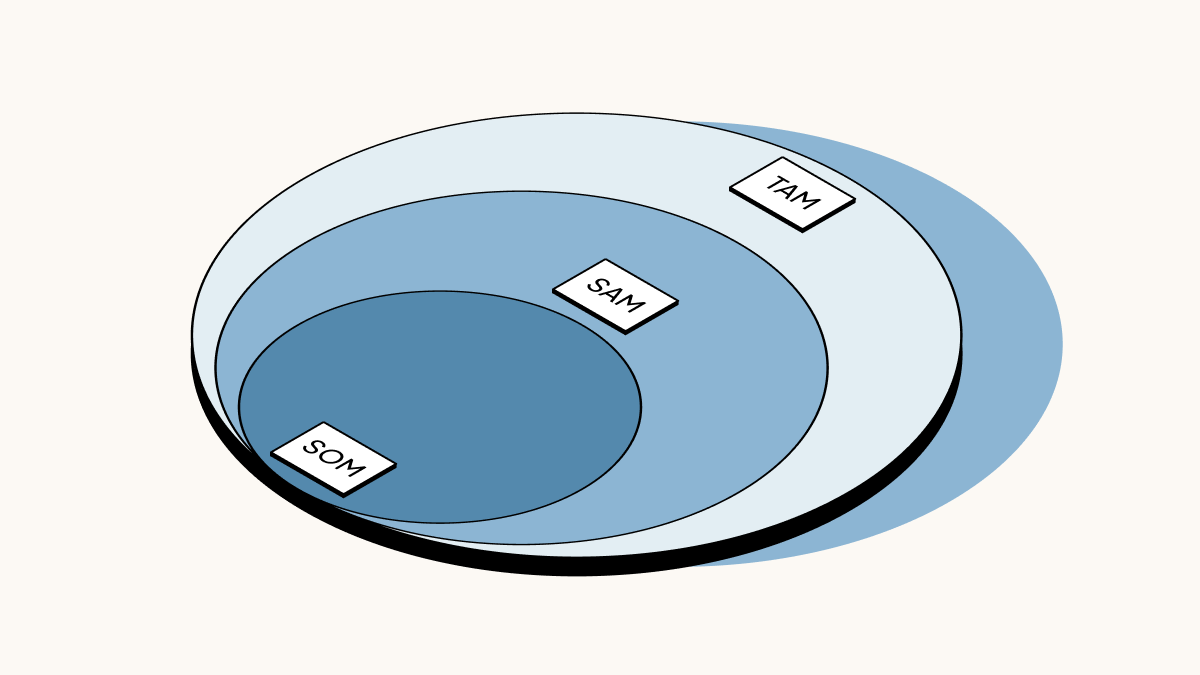

Total Addressable Market (TAM):

Customers/Users: 93.9M - 187.9M

Revenue: $2.05B - $8.13B

Serviceable Addressable Market (SAM):

Customers/Users: 31.3M - 93.9M

Revenue: $687.2M - $4.08B

Executive Summary

Too Good To Go is the world's largest marketplace for surplus food, operating in 16 European countries and the US. The company aims to reduce food waste by enabling users to purchase unsold food items from local retailers, cafes, and restaurants at discounted prices. With over 100 million registered users and 170,000 business partners, Too Good To Go has established a significant presence in the food waste reduction market.

The total addressable market (TAM) for Too Good To Go is estimated to range from $2.05 billion to $8.13 billion in revenue, considering the combined population of the EU and the US, potential smartphone users, and potential business partners. The serviceable addressable market (SAM), taking into account the company's current market presence and growth potential, is estimated to range from $687 million to $4.08 billion in revenue.

The food waste reduction market is highly competitive, with several players offering similar services. OLIO, Phenix, and Karma are among the top competitors in Europe, while Flashfood and Full Harvest are notable players in the US market. Additionally, companies like Winnow, LeanPath, Wasteless, and Apeel Sciences are addressing food waste through innovative technologies and solutions.

Despite the competition, Too Good To Go has established itself as a market leader, leveraging its extensive user base and partnerships with businesses. However, the company faces challenges in expanding its reach and capturing a larger share of the addressable market, particularly in the face of growing environmental consciousness and consumer demand for sustainable solutions.

Key Data Points

-

Population:

-

Smartphone penetration:

-

UK - 83%

-

Germany - 79.9%

-

France - 77.5% [10]

-

-

Food waste:

-

Consumer spending: Average annual food at-home expenditure in US - $6,053 [1][3]

-

Surplus food market: Global value of $56.8 billion in 2024, expected to reach $89.14 billion by 2030 [39]

-

Restaurant industry:

-

Consumer attitudes: 36% of European consumers want food companies to limit food waste [56]

-

Too Good To Go pricing: Retailers pay annual fee of $89 and commission of $1.79 per item sold

-

Too Good To Go current user base: Over 100 million registered users and 170,000 business partners

Market Size Calculations

Total Addressable Market (TAM) Calculations:

-

Total addressable population: EU population + US population = 448,800,000 + 334,000,000 = 782,800,000

-

Smartphone users (potential app users): 782,800,000 * 80% (average smartphone penetration) = 626,240,000

-

Potential business partners:

-

EU: 900,000

-

US: (13,200,000 employees * 900,000 businesses) / 5,000,000 employees = 2,376,000

-

Total potential business partners: 900,000 + 2,376,000 = 3,276,000

-

-

TAM Customers:

-

Low estimate: 626,240,000 * 15% = 93,936,000

-

High estimate: 626,240,000 * 30% = 187,872,000

-

-

TAM Revenue:

-

Low estimate:

-

Annual fee: 3,276,000 * 10% * $89 = $29,156,400

-

Commission: 93,936,000 * 12 (purchases per year) * $1.79 = $2,017,747,968

-

Total low estimate: $29,156,400 + $2,017,747,968 = $2,046,904,368

-

-

High estimate:

-

Annual fee: 3,276,000 * 20% * $89 = $58,312,800

-

Commission: 187,872,000 * 24 (purchases per year) * $1.79 = $8,070,991,872

-

Total high estimate: $58,312,800 + $8,070,991,872 = $8,129,304,672

-

-

Serviceable Addressable Market (SAM) Calculations:

-

SAM Customers (considering current market presence and growth potential):

-

Low estimate: 626,240,000 * 5% = 31,312,000

-

High estimate: 626,240,000 * 15% = 93,936,000

-

-

SAM Business Partners:

-

Low estimate: 3,276,000 * 5% = 163,800

-

High estimate: 3,276,000 * 15% = 491,400

-

-

SAM Revenue:

-

Low estimate:

-

Annual fee: 163,800 * $89 = $14,578,200

-

Commission: 31,312,000 * 12 (purchases per year) * $1.79 = $672,582,656

-

Total low estimate: $14,578,200 + $672,582,656 = $687,160,856

-

-

High estimate:

-

Annual fee: 491,400 * $89 = $43,734,600

-

Commission: 93,936,000 * 24 (purchases per year) * $1.79 = $4,035,495,936

-

Total high estimate: $43,734,600 + $4,035,495,936 = $4,079,230,536

-

-

Assumptions

Proxy Data

-

For adoption rates of food waste reduction apps, we can use the data from OLIO and Phenix as proxies. OLIO had 2.5 million downloads and Phenix had 1.3 million downloads in the past year [60][61]. We can use these figures to estimate potential adoption rates for Too Good To Go in new markets.

-

For smartphone penetration rates in European countries where specific data is not available, we can use the average of the given rates (UK - 83%, Germany - 79.9%, France - 77.5%) [10], which is approximately 80%. This serves as a reasonable proxy for other European countries.

-

To estimate the number of potential business partners, we can use the European restaurant and takeaway industry data, which mentions approximately 900,000 businesses [48]. For the US, we can use the ratio of businesses to employees in the European market and apply it to the US restaurant employee count of 13.2 million [7].

Assumptions

-

Market penetration: Given Too Good To Go's current user base of over 100 million registered users across 17 countries (16 European countries plus the US), we can assume a potential market penetration of 15-30% in mature markets and 5-15% in newer markets. This assumption is based on the app's current success and the growing consumer interest in sustainability and food waste reduction [56][57].

-

Average purchase frequency: Assuming users make purchases through the app 1-2 times per month, based on the fact that 30.52% of US citizens used to dine out a few times a month [14]. This is a conservative estimate considering the app offers discounted prices.

-

Average item price: Based on the commission of $1.79 per item sold and assuming this represents about 10-20% of the item's discounted price, we can estimate an average item price range of $8.95 to $17.90.

-

Business partner adoption: Assuming 10-20% of food businesses in target markets could potentially become partners, based on the current 170,000 business partners and the growing interest in sustainability initiatives [17].

-

Surplus food availability: Assuming each business partner has an average of 3-5 surplus food items available per day, based on the significant amount of food waste generated in the EU and US [5][33].

These assumptions are based on the provided data and logical reasoning, considering the current success of Too Good To Go and the growing trend towards sustainability and food waste reduction.

Our Methodology / Thought Process

To calculate the Total Addressable Market (TAM) and Serviceable Available Market (SAM) for Too Good To Go, we followed a structured approach considering various data points and making reasonable assumptions. Here's the thought process:

-

We started by identifying the total addressable population in the target markets, which are the European Union (EU) countries and the United States (US). The combined population of these regions is approximately 782.8 million people.

-

Next, we considered the smartphone penetration rates in these markets, as Too Good To Go is a mobile app. Using the available data for major European countries, we assumed an average smartphone penetration rate of 80%. Applying this rate to the total population, we estimated the potential app user base to be around 626.24 million people.

-

To estimate the potential business partners, we used the data on the number of restaurants and food businesses in the EU (900,000) and the US (2.376 million, calculated based on the ratio of businesses to employees). This gave us a total of 3.276 million potential business partners.

-

For the TAM calculation, we made assumptions about the potential market penetration rates for Too Good To Go, considering its current success and the growing consumer interest in sustainability and food waste reduction. We assumed a range of 15-30% market penetration in mature markets and 5-15% in newer markets.

-

Based on these assumptions, we calculated the TAM customers to be between 93.936 million (low estimate) and 187.872 million (high estimate).

-

To estimate the TAM revenue, we considered two revenue streams for Too Good To Go: the annual fee paid by business partners ($89) and the commission per item sold ($1.79). We made assumptions about the adoption rates of business partners (10-20%) and the average purchase frequency of users (1-2 times per month).

-

Using these assumptions, we calculated the TAM revenue to be between $2.046 billion (low estimate) and $8.129 billion (high estimate).

-

For the SAM calculation, we considered Too Good To Go's current market presence and growth potential. We assumed a more conservative range of 5-15% market penetration for customers and business partners.

-

Based on these assumptions, we calculated the SAM customers to be between 31.312 million (low estimate) and 93.936 million (high estimate), and the SAM business partners to be between 163,800 (low estimate) and 491,400 (high estimate).

-

Finally, we calculated the SAM revenue using the same methodology as the TAM revenue, considering the lower range of customer and business partner adoption. The SAM revenue ranged from $687.16 million (low estimate) to $4.079 billion (high estimate).

Throughout the process, we relied on various data sources, including population statistics, industry reports, consumer behavior studies, and pricing information from Too Good To Go. We also made reasonable assumptions based on logical reasoning and the current success of the app in addressing the growing concern for sustainability and food waste reduction.

Competitor Research Summary

- OLIO: OLIO is a popular alternative to Too Good To Go, offering a free service that connects neighbors and local shops to share surplus food and reduce waste. It has 2.5 million downloads in the past year, making it the second most popular app in this space after Too Good To Go. OLIO is available in the UK and other European countries [60][61].

- Phenix: Phenix is the third most popular food waste app with 1.3 million downloads in the past year. It's primarily a B2B food waste app, connecting businesses with merchants that have surplus food. Phenix is available in France and other European countries [60][61].

- Karma: Karma is a Swedish app that connects restaurants, cafes, and grocery stores with users eager to purchase unsold food at a lower price. It has fewer downloads (101k) compared to the top players [60].

- Flashfood: Flashfood is a platform that helps users find food items close to their best-before dates, purchase them at reduced prices, and pick them up in-store. This approach reduces losses and carbon footprint [64].

- Full Harvest: Full Harvest is a B2B online marketplace that aims to capture the quarter of edible produce that doesn't leave the farm. It provides enhanced data insights around produce availability, pricing, quality, and forecasting, connecting farms and commercial produce buyers to reduce waste by selling surplus fruits and vegetables [59][63].

- Winnow: Winnow uses AI and computer vision to track food waste in commercial kitchens. It photographs discarded food, trains machines to recognize waste, and provides insights to reduce waste by up to 50% [62].

- LeanPath: LeanPath tracks and analyzes food waste data to identify areas of high waste and provides recommendations for reduction. Its digital platform allows real-time tracking and goal-setting [62].

- Wasteless: Wasteless uses AI-powered dynamic pricing strategies to minimize food waste by capturing the full value of perishable produce in real-time [63].

Summary of Collected Data

Financial Data

- Food Expenditure:

- The average annual food at-home expenditure of U.S. households in 2023 was $6,053 [1][3].

- Americans spend about 6.4% of their household income on food [4].

- In 1997, U.S. consumers spent 13.8% of household expenditures on food, while the EU as a whole spent 17.4% [2].

- Food Waste:

- The European Union generated over 58 million tons of food waste in 2021, with private households accounting for 54% (31 million tons) [5].

- The average person in the EU generated 131 kg of food waste in 2021, with Cyprus having the highest amount at around 400 kg per capita [5].

- In the United States, the total surplus food generated in 2021 was 91 million tons, with households producing nearly half of this surplus [33].

- Restaurant Industry:

- In 2023, the U.S. had 13.2 million restaurant employees, supporting an industry with sales reaching 1.09 trillion U.S. dollars [7].

- The European restaurant and takeaway industry was valued at 360 billion euros in 2023 [48].

- Food Delivery Market:

- The European food delivery market is projected to grow with a CAGR of 11% from 2023 to 2031, reaching a value of approximately $40.77 billion by 2031 [20].

- The US online food delivery market is expected to reach $66.54 billion by 2032 with a CAGR of 9.93% [19].

- Surplus Food Market:

- The global surplus food market was valued at USD 56.8 billion in 2024 and is expected to grow at a CAGR of 7.8% to reach USD 89.14 billion by 2030 [39].

- Europe leads the global surplus food market, accounting for approximately 38% of the market share in 2024 [39].

- Food and Beverage Industry:

- The Food market in Europe is projected to grow by 5.35% from 2024 to 2029, reaching a market volume of US$2,629.00 billion in 2029 [40].

- The estimated revenue of the food and beverage retail industry in the US was US$738.2 billion in 2022 [41].

- Consumer Spending:

- Consumer spending on digital video in Europe reached 24.39 billion euros in 2023, up from 1.3 billion euros in 2013 [42][44].

- The total consumer spending on video in Europe grew significantly from 2019 to 2023, reaching over 26.4 billion euros [43].

- Hospitality Industry:

-

The revenue of the hotel market in Europe reached $111 billion in 2023 [45].

-

Central & Western Europe generated over $68 billion in hotel revenue in 2023 [46].

Behavioral Data

- Food Waste Behavior:

- The average EU citizen generates 132 kilograms of food waste per year, with households responsible for 54% of this waste [8][9].

- Cyprus has the highest amount of food waste per capita at around 400 kg, followed by Belgium, Denmark, Greece, and Portugal [52].

- In Germany, households produce more than six million metric tons of food waste annually [53].

- Consumer Attitudes towards Sustainability:

- 36% of consumers in Europe want food and beverage companies to limit their food waste [56].

- 27% of consumers want companies to use recycled materials in products and packaging [56].

- 71% of consumers in France, 69% in Germany, 68% in Italy, and 65% in the UK agree that sustainable brands have a better reputation [57].

- In Europe, 71% of consumers consider sustainability important when buying fashion [57].

- Mobile App Usage:

- European users amassed approximately 6.4 billion app downloads from Google Play and the Apple App Store in the third quarter of 2021 [36].

- Consumer spending on mobile apps in Europe increased by 21.6% in the third quarter of 2021, reaching $4.5 billion [36].

- Social media apps in Europe were used for around 65 minutes per day on average in 2021 [36].

- Online Food Delivery:

- Online food delivery users in Europe are forecast to reach about 242 million for meal delivery and around 193 million for grocery delivery by 2024 [13].

- France had the highest food e-commerce penetration rate among selected European markets at 64 percent in 2023 [49].

- Dining Out Habits:

- In 2019, 30.52% of US citizens used to dine out a few times a month [14].

- Environmental Consciousness:

- Scandinavian countries like Sweden have high levels of environmental consciousness [35].

- 29 percent of survey respondents in Spain and nearly 19 percent in Germany considered food sustainability as one of their top five most important issues personally in 2023 [51].

- Internet Usage:

- 96% of young people aged 16-29 in the EU use the internet daily, with the highest shares in Ireland (100%) and seven other EU members [37].

- Europe had approximately 680 million social networking users in 2023 [38].

- Smartphone Penetration:

- Smartphone penetration rates vary across European countries, with the United Kingdom at 83%, Germany at 79.9%, and France at 77.5% in 2023 [10].

- Surplus Food Purchasing:

- In the US, Flashfood users save an average of $96 per month on grocery bills due to the discounted prices of surplus food [34].

- Urbanization Trends:

- The share of children and young adolescents (those aged below 15) decreased from 16.4% to 14.9% between 2003 and 2023 in the EU, indicating a shift towards more urban populations [55].

- Sustainable Packaging Preferences:

- Turkish online consumers value sustainable packaging the most, followed by consumers in other European countries like Czechia, France, Germany, Poland, and Sweden [58].

- Food Expenditure:

-

The average annual food at-home expenditure of U.S. households in 2023 was $6,053 [1][3].

-

Americans spend about 6.4% of their household income on food [4].

Competitor Data

- Food Waste Reduction Apps and Platforms:

-

Karma: Available in Sweden, Denmark, Norway, Finland, France, Italy, Spain, Germany, Poland, Austria, Belgium, Luxembourg, Netherlands, Switzerland, and the United Kingdom. Enables restaurants to sell excess food at reduced prices [21].

-

Winnow: Available in 19 countries including Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Ireland, Italy, Japan, Netherlands, New Zealand, Norway, Poland, Portugal, Spain, Sweden, Switzerland, and the United Kingdom. Employs smart technology to monitor and minimize kitchen waste [21].

-

LeanPath: Available in 14 countries including the United States, Canada, United Kingdom, Ireland, Australia, New Zealand, France, Germany, Netherlands, Sweden, Denmark, Norway, Finland, and Belgium. Offers tools to track and analyze food waste [21].

-

OzHarvest: Available in Australia, New Zealand, and the United Kingdom. A nonprofit organization rescuing surplus food from restaurants and delivering it to charities [21].

-

OLIO: Has 2.5 million downloads, with a two-fold increase in the past year. Available in the UK and other European countries [22].

-

Phenix: Has 1.3 million downloads, with more than half of its downloads coming in the past year. Available in France and other European countries [22].

- Food Delivery Apps:

-

Deliveroo: A leading player in the European food delivery market, particularly strong in the UK [18].

-

Uber Eats: A major player in the European food delivery market, particularly strong in France [18].

-

Just Eat: A significant player in the European food delivery market, gaining traction in Spain [18].

-

Glovo: The largest aggregator platform in Spain [18].

-

Lieferando: Dominated the food delivery market in Germany in 2022, capturing around 76% of all online food orders made by German consumers [12].

- General Food and Beverage Industry:

-

The European restaurant and takeaway industry was valued at 360 billion euros in 2023, with approximately five million employees and over 900,000 businesses [48].

-

The food market in Europe is expected to show a volume growth of 2.4% in 2025, with an average volume per person of 521.90 kg in 2024 [50].

-

The revenue of the hotel market in Europe reached $111 billion in 2023, making it the second-largest share of revenue in the tourism industry [45].

- Sustainability Initiatives:

-

Various voluntary agreements and initiatives to reduce food waste exist across Europe. For example, in Austria, a digital hub is being organized to facilitate the logistics and distribution of food intended for donations, involving over 100 partners [17].

-

In Greece, an alliance to reduce food waste includes around 80 members across the food supply chain, promoting data collection and annual reports to reduce waste by 30% at distribution and consumption levels [17].

These competitors and industry trends highlight the growing focus on food waste reduction, sustainable practices, and digital solutions in the European and US food industries.

Demographic Data

- Population:

- The total population of the European Union (EU) was approximately 448.8 million people as of January 1, 2023 [47].

- The most populous EU countries were Germany (84.4 million), France (68.2 million), Italy (59.0 million), Spain (48.1 million), and Poland (36.8 million) [47].

- The United States population was approximately 334 million people in 2022 [6].

- Age Distribution:

- In the EU, children (0-14 years) made up 14.9% of the population, people of working age (15-64 years) accounted for 63.8%, and older people (aged 65 years and over) had a 21.3% share [23].

- The median age of the EU population increased from 39.0 years in 2003 to 44.5 years in 2023 [47].

- The highest median age was observed in Italy (48.4 years), followed by Portugal (47.0), Bulgaria (46.8), and Greece (46.5) [47].

- Gender Distribution:

- In the EU, there were more women than men, with a ratio of 104.6 women per 100 men [47].

- The highest rates of more women than men were found in Latvia (16% more) and Lithuania (14% more) [47].

- Life Expectancy:

- In the EU, women lived longer than men, with life expectancy at birth being 84.2 years for women and 78.9 years for men, a difference of 5.3 years [47].

- The highest life expectancies at birth were recorded in Spain (84.0) and Italy (83.8), while the lowest were in Bulgaria (75.8) and Latvia (75.9) [47].

- Urbanization:

- The share of the population living in urban areas varies significantly across European countries. For example, in Belarus, over 80% of the population resided in cities and towns, followed closely by Russia with approximately 75% [54].

- In the United States, approximately 82.66% of the total population lived in cities and urban areas in 2020 [26].

- Education Levels:

- In the EU, around 44% of Europeans held an upper secondary school title in 2023 [27].

- Ireland had the highest share of graduates, with almost 47% of those aged between 15 and 64 having a degree [29].

- In 2023, 43% of people in the EU aged between 25 and 34 had a degree [28].

- Employment:

- The Netherlands had the highest employment rate in the EU at 82.5% in 2024 [30].

- The overall unemployment rate in the European Union was 5.9% in August 2024 [32].

- In the United States, the employment rate for Americans ages 16 to 64 has fallen to 72.7% from 75.3% at the end of 2007 [31].

- Income Levels:

- In Europe, the top 10 percent took home over a third of national income, while the bottom half earned less than a fifth [24].

- In the United States, just over 50 percent of Americans had an annual household income that was less than $75,000, and the median household income was $80,610 [25].

- Digital Adoption:

- In Europe, 96% of young people aged 16-29 in the EU use the internet daily [37].

- The smartphone penetration rate in the United States was over 96% in 2024 [11].

- Environmental Consciousness:

-

In 2023, 29 percent of survey respondents in Spain and nearly 19 percent in Germany considered food sustainability as one of their top five most important issues personally [16].

-

In the United States, approximately 43 percent of U.S. adults aged 18-29 considered food waste a very big problem worldwide [15].

Subscribe to our newsletter to get latest news in your inbox.

© 2025 Aurora. All Rights Reserved