Oct 08, 2024

The Importance of Market Size to Startup Investors

Why market size (TAM SAM SOM) is so important to investors, and why founders need to pay more attention to it

For entrepreneurs seeking venture capital funding, presenting a compelling market size is crucial in capturing investors' attention. Venture capitalists (VCs) meticulously evaluate the potential market for a startup's product or service, as this factor significantly influences the company's growth prospects and the likelihood of achieving a substantial exit. In this comprehensive guide, we delve into the rationale behind investors' keen interest in market size and provide actionable insights to help startups effectively communicate their market potential.

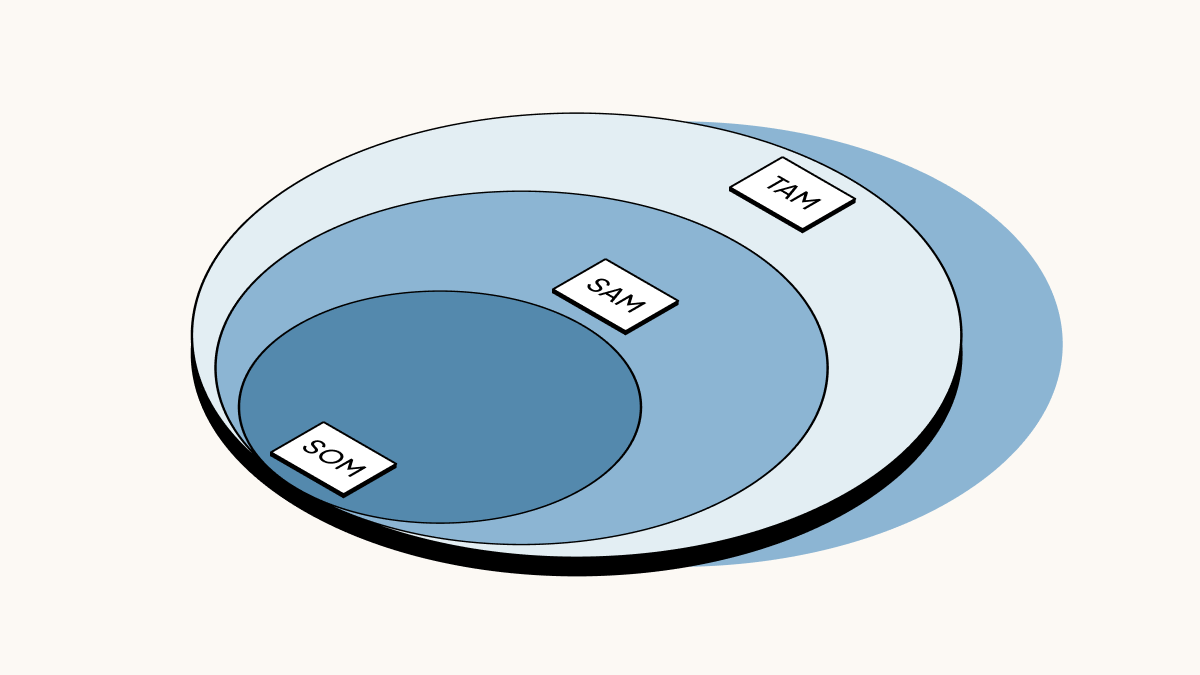

Defining Market Size: TAM, SAM, and SOM

Before delving into the significance of market size, it's essential to understand the three key terms most often used to quantify a market's potential: Total Addressable Market (TAM), Serviceable Addressable Market (SAM), and Serviceable Obtainable Market (SOM).

Total Addressable Market (TAM)

The Total Addressable Market (TAM) represents the entire potential market demand for a product or service. It encompasses all potential customers, regardless of their location, demographics, or specific needs. TAM provides a broad overview of the market's size and serves as a starting point for further analysis.

Serviceable Addressable Market (SAM)

The Serviceable Addressable Market (SAM) is a subset of the TAM, representing the portion of the market that a company can realistically target and serve. It considers factors such as geographic constraints, demographic characteristics, and specific customer requirements that align with the company's capabilities and resources.

Serviceable Obtainable Market (SOM)

The Serviceable Obtainable Market (SOM) is the segment of the SAM that a company can reasonably expect to capture within a given timeframe. It takes into account factors such as competition, market acceptance, and the company's ability to execute its marketing and sales strategies effectively.

The Significance of Market Size for Investors

Venture capitalists prioritize market size for several compelling reasons:

1. Potential for Scalability and Growth

Investors seek opportunities with substantial growth potential, as their primary objective is to generate significant returns on their investments. A large market size indicates the possibility for a startup to scale rapidly and capture a substantial portion of the addressable market, leading to substantial revenue growth and increased valuation.

2. Mitigating Risk and Ensuring Longevity

A sizable market not only offers growth potential but also reduces the risk associated with investing in a startup. A larger addressable market typically translates to a more diverse customer base, which can help mitigate the impact of market fluctuations or changes in consumer preferences. This diversification enhances the startup's resilience and longevity, factors that are highly valued by investors.

3. Attracting Follow-on Investments

Successful startups often require multiple rounds of funding to fuel their growth and expansion. A substantial market size can attract follow-on investments from existing and new investors, as it demonstrates the potential for continued growth and the ability to generate substantial returns over time.

4. Facilitating Successful Exits

Venture capitalists ultimately seek exits that generate significant returns on their investments. A large market size increases the likelihood of a successful exit, whether through an initial public offering (IPO) or an acquisition by a larger company. Companies operating in sizeable markets are more attractive acquisition targets, as they offer strategic value and growth opportunities for the acquiring entity.

Calculating Market Size: A Strategic Approach

Accurately estimating market size is a critical component of a startup's pitch and business plan. It involves a systematic approach that combines top-down and bottom-up methodologies, as well as a thorough understanding of the target market and industry dynamics.

Top-Down Approach

The top-down approach begins with a broad estimate of the total market demand for a product or service. This initial estimate is then refined by segmenting the market based on various factors, such as geographic location, demographic characteristics, and specific customer needs. This approach provides a comprehensive overview of the market landscape and helps identify potential opportunities and challenges.

Bottom-Up Approach

The bottom-up approach, on the other hand, involves building an estimate from the ground up, starting with specific data points and usage assumptions. This approach is particularly useful when dealing with niche markets or specialized products, as it allows for a more granular understanding of customer behavior and consumption patterns.

Combining Methodologies for Accurate Estimation

To achieve a comprehensive and accurate market size estimation, startups should leverage both top-down and bottom-up approaches. By triangulating data from multiple sources and using various methodologies, startups can validate their assumptions and refine their market size estimates, ensuring a more reliable and credible representation of the market potential.

Presenting Market Size Effectively

Once a startup has conducted thorough market size calculations, it's crucial to present this information effectively in pitch decks and investor presentations. Here are some best practices for effectively communicating market size:

1. Visual Representation

Utilize visually appealing charts, graphs, and infographics to convey market size data in a clear and concise manner. These visual aids can help investors quickly grasp the magnitude of the opportunity and facilitate a better understanding of the market dynamics.

2. Storytelling and Narrative

Crafting a compelling narrative around market size can be highly effective in capturing investors' attention and making the information more memorable. By weaving market size data into a cohesive story that resonates with investors, startups can create a stronger emotional connection and emphasize the potential impact of their solution.

3. Addressing Assumptions and Limitations

While presenting market size estimates, it's essential to address the assumptions and limitations underlying the calculations transparently. Investors appreciate honesty and will likely scrutinize the data, so being upfront about potential limitations can enhance credibility and foster trust.

4. Benchmarking and Comparisons

Comparing the startup's market size to established companies or industry benchmarks can provide valuable context and help investors better understand the magnitude of the opportunity. However, it's crucial to ensure that these comparisons are relevant and well-justified.

Addressing Common Challenges in Market Size Estimation

While estimating market size is a critical exercise, it is not without its challenges. Startups may encounter various obstacles and uncertainties during the process, such as:

1. Limited Data Availability

In some cases, particularly for innovative or disruptive products or services, there may be limited historical data or market research available. In such situations, startups may need to rely on primary research, industry benchmarks, or make reasonable assumptions based on available information.

2. Dynamic Market Conditions

Markets are constantly evolving, with new trends, technologies, and consumer preferences emerging regularly. Startups must be prepared to adapt their market size estimates to account for these dynamic conditions and adjust their strategies accordingly.

3. Competitive Landscape

The competitive landscape can significantly impact a startup's ability to capture market share. It's essential to consider the presence of established players, their market dominance, and the potential for new entrants when estimating the serviceable obtainable market (SOM).

4. Regulatory and Legal Considerations

Certain industries or markets may be subject to regulatory constraints or legal limitations that can impact market size estimates. Startups must carefully consider these factors and incorporate them into their calculations to ensure accuracy and compliance.

Conclusion

In the highly competitive world of startups and venture capital, market size plays a pivotal role in attracting investors and securing funding. By presenting a compelling market size estimate, startups can demonstrate the potential for scalability, growth, and substantial returns, factors that are highly valued by venture capitalists.

However, accurately estimating market size requires a strategic approach that combines top-down and bottom-up methodologies, leverages industry data and market research, and accounts for dynamic market conditions and competitive landscapes. Additionally, effective communication and visual representation of market size data can significantly enhance a startup's pitch and increase the likelihood of capturing investors' attention.

By understanding the importance of market size and mastering the art of market size estimation and presentation, startups can position themselves for success in their fundraising efforts and pave the way for long-term growth and profitability.

Subscribe to our newsletter to get latest news in your inbox.

© 2025 Aurora. All Rights Reserved