Jan 13, 2025

Market Size Report: Tacombi

Calculating the market size of Tacombi with Aurora

Have you ever wondered what the market size was for your company? Ever thought of a product idea and been curious how huge it could be? Ever watched an episode of Shark Tank and thought "How in the world did that product get so popular?" Well, here at Aurora we sure did!

That's why we set out to build our Market Size Calculator. Within as little as 5 minutes, you can get a custom market sizing report based on verifiable data and transparent calculations. Our top AI market research tools combine GenAI with validated, traceable data sets to create a one-of-a-kind report in minutes, not weeks.

For this example report, I decided to do something very near and dear to my heart (and stomach) - Tacombi. Their Taco Tuesday deals are almost a weekly occurence for my partner and I at this point. Given my ongoing obsession, we decided to run a market sizing report for their business.

Please see the report Aurora generated below, and if you have any thoughts or questions you can email us here.

Market Size Figures

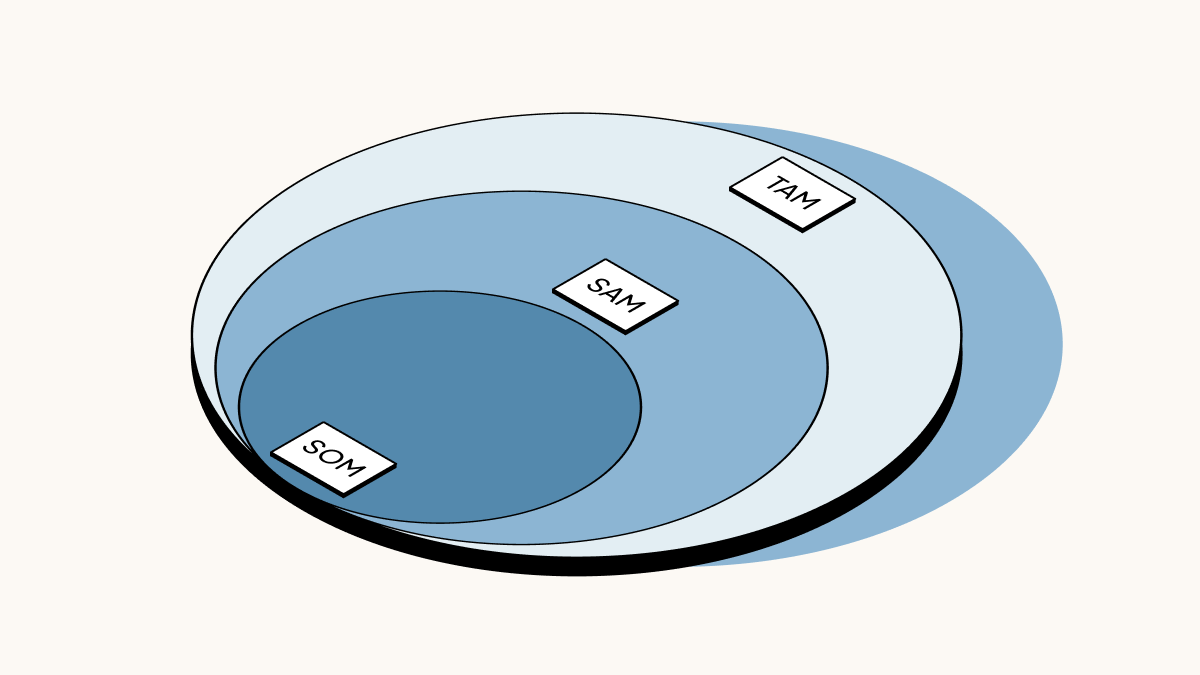

Total Addressable Market (TAM):

Customers: 233.10M

Revenue: $100.36B

Serviceable Addressable Market (SAM):

Customers: 161k - 322k

Revenue: $100.58M - $251.45M

Executive Summary

Tacombi is a fast-casual Mexican restaurant chain operating in the United States, with a focus on authentic Mexican cuisine and hospitality. The company currently has 20 locations across New York, Chicago, Miami, Connecticut, Maryland, New Jersey, and Virginia, with plans for further expansion nationwide.

The Total Addressable Market (TAM) for Tacombi is estimated to be around $100.36 billion, based on calculations using the Mexican restaurant industry market size and the total number of Mexican cuisine consumers in the United States. The Serviceable Addressable Market (SAM) for Tacombi ranges from approximately $100.58 million to $251.45 million, considering the population in the company's current and near-term markets, frequent fast-casual diners, and potential annual visits and revenue.

The fast-casual Mexican restaurant segment is highly competitive, with major players like Chipotle Mexican Grill, which generated $9.87 billion in revenue in 2023 and has over 3,500 restaurants globally. Other competitors include local independent taquerias, known for their authenticity and unique cultural experiences, and regional chains like Dos Toros Taqueria, which operates primarily in New York and Chicago.

Key factors influencing the market include consumer preferences for customizable options, health-conscious and fresh ingredients, digital ordering capabilities, and loyalty programs. Economic factors such as inflation and cost-conscious consumer behavior also play a role in shaping the competitive landscape and consumer spending habits.

Key Data Points

- Total US population: 335.9 million people in 2023 [1][2][3]

- US restaurant industry revenue: $1,094.1 billion in 2023 [8]

- Fast-casual dining industry market size: $45.58 billion in 2023 [71]

- Mexican restaurant industry market size: $88.1 billion in 2022 [12]

- Average household expenditure on food away from home: $2,235 for households with income range $30,000 to $39,999 in 2023 [7]

- Dining frequency: 53% of consumers dined out at least once a week in April 2023 [74]

- Mexican cuisine preference: 233.10 million Americans used Mexican food and ingredients in 2020 [11][60]

- Target market data:

- Competitor data:

- Pricing information:

- Tacombi: Tacos ($5-$7), Quesadillas ($7-$10), Burritos ($14-$15)

- Chipotle: Tacos ($3.80+), Burritos ($11.35+), Quesadillas ($11.90+) [95]

- Growth rate:

Market Size Calculations

Total Addressable Market (TAM) Calculations:

- Using the Mexican restaurant industry market size:

- TAM = $88.1 billion (2022 market size) * (1 + 4.7%)^2 (growth for 2 years at 4.7% annually, the growth rate of the Mexican restaurant market in the US)

- TAM = $88.1 billion * 1.0963 = $96.58 billion

- Using the total number of Mexican cuisine consumers and average spending:

- Total consumers: 233.10 million Average annual spending on food away from home: $2,235

- Assuming 20% of this spending is on Mexican food (conservative estimate based on cuisine popularity)

- TAM = 233.10 million * $2,235 * 0.20 = $104.13 billion

- Taking the average of these two methods: TAM = ($96.58 billion + $104.13 billion) / 2 = $100.36 billion

Serviceable Addressable Market (SAM) Calculations:

- Population in Tacombi's current and near-term markets: 51,613,176

- New York City: 8,258,000

- Chicago metro: 9,262,825

- Miami metro: 6,265,000

- Connecticut: 3,605,597

- Maryland: 6,217,062

- New Jersey: 9,288,994

- Virginia: 8,715,698

- Potential customers (69.4% of population, based on Mexican food usage): 51,613,176 * 0.694 = 35,819,544

- Frequent fast-casual diners (45% dine at least once a week): 35,819,544 * 0.45 = 16,118,795

- Potential annual visits (assuming once per week for frequent diners): 16,118,795 * 52 weeks = 838,177,340 visits per year

- Potential annual revenue:

- Low estimate: 838,177,340 * $12 (lower average check) = $10,058,128,080

- High estimate: 838,177,340 * $15 (higher average check) = $12,572,660,100

- Tacombi's potential market share (1-2% of the market):

- Low estimate: $10,058,128,080 * 0.01 = $100,581,281

- High estimate: $12,572,660,100 * 0.02 = $251,453,202

- Therefore, the SAM for Tacombi ranges from approximately $100.58 million to $251.45 million.

To calculate the number of potential customers:

- Low estimate: 16,118,795 * 0.01 = 161,188

- High estimate: 16,118,795 * 0.02 = 322,376

Assumptions

Proxy Data

- For Tacombi's potential market share, we can use Chipotle's market share as a proxy. Chipotle holds approximately 10% of the U.S. fast-casual dining segment [86]. As Tacombi is a smaller chain, we can conservatively estimate its potential market share to be 1-2% of the fast-casual Mexican restaurant market.

- For Tacombi's revenue, we can use the average revenue per restaurant of a similar-sized chain, Dos Toros Taqueria, as a proxy. Dos Toros has an estimated annual revenue of $117.2 million [103] with 21 units [105], which gives us an average of $5.58 million per restaurant. Applying this to Tacombi's 20 restaurants, we can estimate Tacombi's potential revenue to be around $111.6 million annually.

- For the number of potential customers, we can use the percentage of Americans who use Mexican food and ingredients (233.10 million out of 335.9 million, or 69.4% [11][60]) as a proxy for the percentage of people in Tacombi's target markets who might be interested in Mexican cuisine.

Assumptions

- We assume that Tacombi's target market aligns with the general fast-casual dining demographic, which primarily consists of millennials and Gen Z (ages 18-34) [89][90][91]. This assumption is based on the similar targeting of competitors like Chipotle and the urban locations of Tacombi's restaurants.

- We assume that the frequency of dining at fast-casual restaurants (45% of respondents dined at fast-casual restaurants at least once a week [74]) applies to Tacombi's potential customers. This assumption is reasonable given that Tacombi operates in the fast-casual segment.

- We assume that Tacombi's expansion plans will allow it to capture a market share similar to other successful regional chains in the fast-casual Mexican segment. This is based on Tacombi's current presence in major urban areas and plans for further expansion.

- We assume an average check size for Tacombi based on their menu prices. Given that tacos are $5-$7, quesadillas are $7-$10, and burritos are $14-$15, we'll assume an average check size of $12-$15 per customer. This range accounts for customers who might order multiple tacos or a combination of items.

- For the SAM calculation, we'll focus on the current and near-term expansion markets of Tacombi, including New York City, Chicago, Miami, and the states of Connecticut, Maryland, New Jersey, and Virginia. We assume that Tacombi can potentially capture 1-2% of the Mexican restaurant market in these areas, given its current presence and expansion plans.

Our Methodology / Thought Process

To calculate the Total Addressable Market (TAM) and Serviceable Addressable Market (SAM) for Tacombi, a fast-casual Mexican restaurant chain, we followed a structured approach by gathering relevant data points and making reasonable assumptions.

Calculating the TAM involved estimating the overall market size for Mexican restaurants in the United States. We considered two methods: using the Mexican restaurant industry market size data and using the total number of Mexican cuisine consumers and their average spending on food away from home.

- For the first method, we took the 2022 Mexican restaurant industry market size of $88.1 billion and applied a growth rate of 4.7% annually for two years, resulting in a TAM of $96.58 billion.

- For the second method, we multiplied the number of Americans who use Mexican food and ingredients (233.10 million) by the average annual spending on food away from home ($2,235) and assumed that 20% of this spending is on Mexican food, resulting in a TAM of $104.13 billion.

- To arrive at a more conservative estimate, we took the average of these two methods, giving us a TAM of $100.36 billion.

Calculating the SAM involved focusing on Tacombi's current and near-term expansion markets, including New York City, Chicago, Miami, and the states of Connecticut, Maryland, New Jersey, and Virginia. We made the following assumptions and calculations:

- Determined the total population in these markets (51,613,176 people).

- Assumed that 69.4% of this population (based on Mexican food usage) would be potential customers, resulting in 35,819,544 potential customers.

- Assumed that 45% of these potential customers are frequent fast-casual diners (based on industry data), resulting in 16,118,795 potential customers.

- Estimated the potential annual visits by assuming these frequent diners visit once per week, resulting in 838,177,340 visits per year.

- Calculated the potential annual revenue by multiplying the potential annual visits by an assumed average check size range of $12 to $15, resulting in a range of $10,058,128,080 to $12,572,660,100.

- Assumed that Tacombi could capture 1-2% of this market, resulting in a SAM range of $100.58 million to $251.45 million.

- Calculated the number of potential customers for Tacombi by applying the 1-2% market share assumption to the frequent fast-casual diners, resulting in a range of 161,188 to 322,376 potential customers.

It's important to note that these calculations are based on various assumptions and proxy data, and the actual TAM and SAM may vary depending on factors such as market conditions, competition, and Tacombi's expansion strategies.

Competitor Research Summary

- Revenue estimated at $5-6.9 million annually [84]

- 42-44 employees [83][84]

- Locations in New York City, including Chelsea Market and Financial District [80][82]

- Menu prices: Tacos $3.50-$5.65, Quesadillas $5.25-$9 [85]

- Known for authentic Mexican street food and handmade tortillas [80][81]

- Popular items include carne asada, pollo asado, and adobada tacos [85]

- Revenue of $9.87 billion in 2023, with 14.33% year-over-year growth [87][88]

- Approximately 10% market share in U.S. fast-casual dining segment [86]

- Over 3,500 restaurants globally as of June 2024 [92][94]

- Menu prices: Tacos $3.80+, Burritos $11.35+, Quesadillas $11.90+ [95]

- Target market primarily millennials and Gen Z (ages 18-34) [89][90][91]

- Known for customizable options and focus on food quality and sustainability [93]

- Estimated annual revenue of $117.2 million in 2024 [103]

- Approximately 206 employees [109]

- 21 units across New York and Chicago [105]

- Menu prices: Tacos around $3.90, Burritos $7.81-$8.27, Quesadillas $4.13-$6.43 [104]

- Target market primarily young adults in their 20s and 30s [106][107]

- Known for Mission-style burritos and focus on fresh, high-quality ingredients [108][110]

Local independent taquerias:

- Varied pricing strategies, with basic tacos often starting around $3-4 [98][99]

- Often use recipe costing and tiered pricing to optimize profitability [98][100]

- Target diverse customer base, including young adults, families, and local communities [101][102]

- Emphasize authenticity, quality ingredients, and unique cultural experiences [101][102]

- Face challenges with rising food costs, affecting profitability [97]

Summary of Collected Data

Financial Data

Total Population and Market Size:

- The current total population of the United States in 2023 is approximately 335.9 million people [1][2][3].

- The total revenue of the quick service restaurant (QSR) industry in the United States in 2023 was $387.5 billion [4].

- The total revenue of the US restaurant industry in 2023 was approximately $1,094.1 billion [8].

Consumer Spending:

- Total food-away-from-home expenditures accounted for 58.5 percent of total food expenditures in 2023, reaching $1.5 trillion [5][6].

- The average household expenditure on food away from home in the United States in 2023 was $2,235 for households with an income range of $30,000 to $39,999 [7].

Mexican Restaurant Market:

- The Mexican restaurant industry in the US was valued at $88.1 billion in 2022 [12].

- The growth rate of the Mexican restaurant market in the US from 2019 to 2024 was 4.7% annually [13].

Fast-Casual Market:

- The market size of the fast-casual dining industry in the United States in 2023 was approximately USD 45.58 billion [71].

- The fast-casual restaurant market is expected to grow at a CAGR of 6.4% between 2025 and 2034, reaching a value of USD 80.02 billion by 2034 [71].

Major Chains Performance:

- Chipotle Mexican Grill generated revenues of approximately $9.87 billion in 2023 [9][14].

- Chipotle had 3,437 restaurants in 2023, up from 3,187 in 2022 [17].

- Qdoba had 165 company-owned stores in 2023 [16].

- Moe's Southwest Grill had 612 units at the end of 2023, down from 681 at the start of 2021 [16].

Consumer Behavior:

- 233.10 million Americans used Mexican food and ingredients in 2020, a figure projected to remain stable until 2024 [11].

- 61% of consumers reported dining out at a restaurant in the past month as of April 2023 [61].

- The total annual spending on quick service restaurants (QSRs) in the United States in 2023 was $349 billion [72][73].

Economic Factors:

- Fast food prices rose by 7.2% over the past year, outpacing the general inflation rate of 5.4% [54].

- Limited-service restaurant prices were up 0.3% in March 2024, with a year-over-year increase of 5% [55].

- Food and drink inflation was the highest of all categories at 12.2% in September 2023 [56].

Behavioral Data

Dining Frequency:

- 53% of consumers in the United States dined out at least once a week in April 2023 [74].

- 29% dined out three to four times a week, and 17% dined out daily [74].

- 43% of respondents dined at full-service restaurants at least once a week [74].

- 45% of respondents dined at fast-casual restaurants at least once a week [74].

- 44% of respondents dined at fast food chains at least once a week [74].

Ordering Behavior:

- 70% of U.S. consumers prefer digital online ordering for off-premise delivery [69].

- 32% of customers order for carryout, 9% for pickup, and 10% via delivery services from fast-casual restaurants [78].

- In the first quarter of 2023, 29% of respondents ordered from burger quick-service restaurants (QSRs) once a week, and another 29% ordered once every couple of weeks [75].

Menu Preferences:

- 62.4% of consumers reported trying new menu items at restaurants occasionally, while 6.9% never tried new menu items [62].

- The top reasons for trying new foods include getting bored with the same items (46%) and liking the introduction to new cuisines (45%) [63].

- Consumers are looking for customizable meal options, including half portions or thinner types of bread, to cater to their dietary needs and preferences [79].

Spending Habits:

- Americans spent an average of $166 per month per person on dining out, with men spending 19% more than women [65].

- The most common reasons for dining out included atmosphere or change of scenery (63%), opportunity to socialize with friends (48%), and better food quality than at home (47%) [65].

Health and Dietary Preferences:

- There is a growing emphasis on healthier eating habits, with consumers seeking fresh, natural, and minimally processed food [79].

- The plant-based food market experienced a decline in 2023, with total dollar sales down 2% and unit sales down 9% [67].

Mexican Cuisine Preferences:

- 233.10 million Americans used Mexican food and ingredients in 2020, a figure projected to remain stable until 2024 [60].

- Nachos were the most popular Mexican dish in the United States as of Q3 2024, with 80% of respondents having a positive opinion of the dish [58].

- Google searches for "Mexican food" increased by 27% per year from 2014 to 2019 and 18% from 2019 to 2021 [59].

Economic Impact on Dining Behavior:

- The leading change in dining habits was selecting cheaper items on menus, with 53% and 55% of respondents choosing this option in fall 2022 and spring 2023, respectively [66].

- 52% of customers considered ordering takeout essential, with 67% of Millennials and 63% of Gen Zers agreeing [65].

Fast-Casual Dining Trends:

- The fast-casual restaurant market is expected to continue growing, with the North American market projected to rise at a CAGR of 8.9% over the forecast period [79].

- Millennials were more likely to choose restaurants offering alcoholic beverages with their takeout orders, with 53% of Millennials and 35% of off-premise customers showing this preference [69].

Demographic Data

Population:

- The current total population of the United States in 2023 is approximately 335.9 million people [1][2][3].

- New York City's population is estimated to be 8,258,000 as of July 1, 2023 [22].

- Chicago's metro area population is 9,262,825 as of 2023 [26].

- Miami's metro area population is 6,265,000 as of 2023 [23].

- Maryland's population is 6,217,062 as of 2023 [24].

- Virginia's population is 8,715,698 as of July 1, 2023 [25].

Household Data:

- The total number of households in the United States in 2023 was 127,482,865 [10].

- The median household income in New York is $81,600 [27].

- The median household income in Connecticut is $92,240 [29].

- The median household income in Maryland is $102,000 [30].

- The median household income in New Jersey is $99,781 [28].

Age Distribution:

- In New York State:

- New York City's median age is 37.5 years [32].

- Miami's median age is 39.7 years [33].

- In Maryland:

- In Virginia:

Ethnic Diversity:

- In New York City:

- In Chicago:

- Approximately three-quarters of Hispanics identify as Mexican (78%) [43].

- In Miami:

These demographic data points provide insights into the population, income, age distribution, ethnic diversity, education levels, employment rates, population density, and consumer behavior in various regions of the United States, particularly focusing on areas relevant to the fast-casual restaurant industry.

Competitor Data

Market Size and Growth:

- The fast-casual restaurant market in the United States was valued at approximately $45.58 billion in 2023 [71].

- The market is projected to grow at a CAGR of 6.4% between 2025 and 2034, reaching a value of $80.02 billion by 2034 [71].

- The quick service restaurant (QSR) sector in the U.S. saw near year-over-year growth, with peak consumer spending exceeding $349 billion in 2023 [70].

Leading Competitors:

Market Trends:

- Digital Ordering: 70% of U.S. consumers prefer digital online ordering for off-premise delivery [69].

- Health-Conscious Options: Increased demand for healthier and more diverse options, including plant-based and organic choices [57].

- Customization: Consumers are looking for customizable meal options to cater to their dietary needs and preferences [79].

- Loyalty Programs: These are highly valued by consumers, driving repeat visits and increasing customer loyalty [77].

Consumer Behavior:

- Dining Frequency: 53% of consumers in the United States dined out at least once a week in April 2023 [74].

- Fast-Casual Preference: 45% of respondents dined at fast-casual restaurants at least once a week [74].

- Off-Premise Orders: 32% of customers order for carryout, 9% for pickup, and 10% via delivery services [78].

Economic Factors:

- Inflation Impact: Fast food prices rose by 7.2% over the past year, outpacing the general inflation rate of 5.4% [54].

- Cost-Conscious Behavior: Consumers are selecting cheaper items on menus more frequently, with 53% and 55% of respondents choosing cheaper options in fall 2022 and spring 2023, respectively [68].

This competitive landscape shows a growing market with strong leaders like Chipotle, while also highlighting the importance of digital ordering, health-conscious options, and adapting to economic pressures in the fast-casual Mexican restaurant segment.

Subscribe to our newsletter to get latest news in your inbox.

© 2025 Aurora. All Rights Reserved