Oct 21, 2024

Mastering Market Sizing Approaches for Startups

Overview of the different approaches to market sizing

In the ever-evolving landscape of entrepreneurship, accurately gauging market potential is paramount for strategic decision-making and sustainable growth. Whether you're a seasoned venture capitalist or an aspiring startup founder, comprehending the art of market sizing is a fundamental skill that can unlock invaluable insights. This comprehensive guide delves into the nuances of market sizing approaches, equipping you with the tools to navigate the complexities of market analysis and position your business for success.

Demystifying Market Sizing

Before embarking on our journey, let's establish a common understanding of the terminology that underpins market sizing. The market size refers to the total potential demand for a product or service, encompassing the number of prospective customers, units sold, or revenue generated. This metric serves as a barometer for assessing the overall market reach and growth prospects.

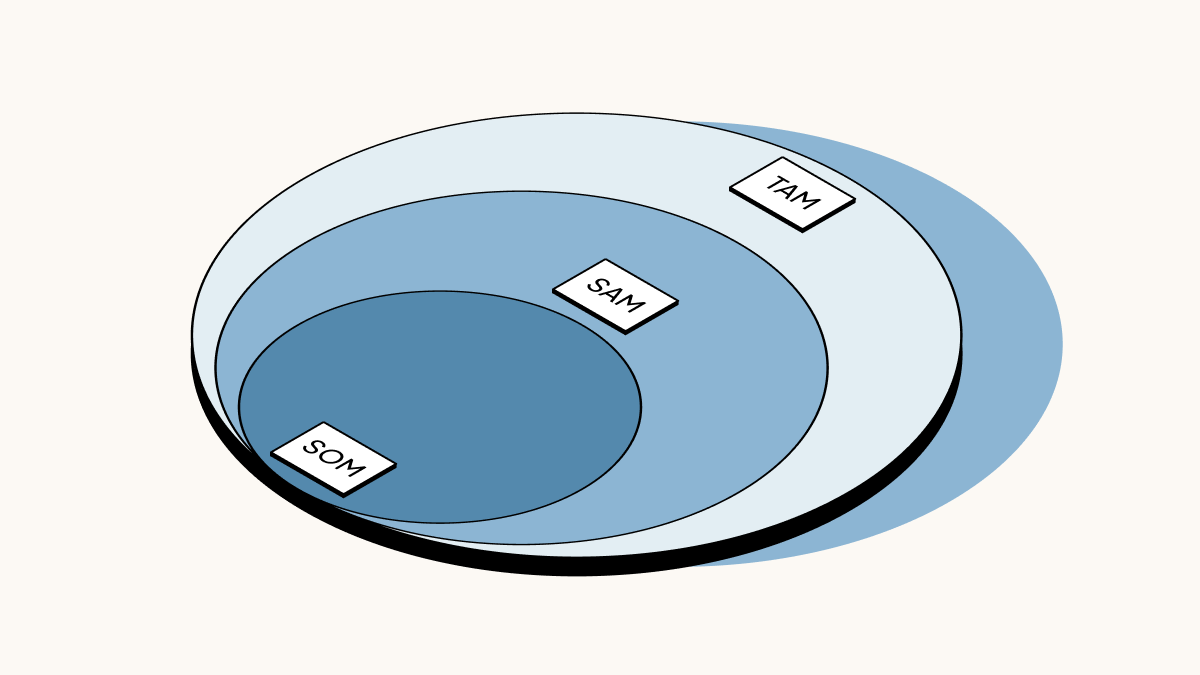

Within this overarching concept, three distinct categories emerge:

-

Total Addressable Market (TAM): This represents the maximum potential revenue or customer base a company could theoretically capture if it held a monopoly in its market, unhindered by competitive barriers or operational constraints.

-

Serviceable Addressable Market (SAM): A subset of the TAM, the SAM delineates the portion of the market that aligns with a company's resources, capabilities, and target customer segments. It accounts for factors such as geography, customer demographics, and market saturation.

-

Serviceable Obtainable Market (SOM): Nestled within the SAM, the SOM encapsulates the market share a company can realistically capture or serve, considering factors like marketing strategies, competitive positioning, and product differentiation.

These market sizing dimensions form a funnel, with the TAM representing the broadest potential and the SOM the most focused and attainable segment. Depending on your objectives, you may prioritize analyzing one aspect over another, tailoring your approach to your specific business needs.

The Significance of Market Sizing

Embarking on a market sizing endeavor is a pivotal undertaking that transcends mere numerical calculations. It equips entrepreneurs and investors with a holistic understanding of market dynamics, enabling informed decision-making across various facets of business strategy.

Here are some compelling reasons why market sizing should be a top priority:

-

Market Evaluation: Whether launching a new product or venturing into uncharted territories, market sizing analyses provide invaluable insights for assessing the viability and potential of emerging opportunities.

-

Market Segmentation: By dissecting the market into distinct segments based on shared characteristics, needs, or behaviors, businesses can tailor their strategies to cater to specific customer groups, maximizing both market share and revenue potential.

-

Competitive Analysis: Gaining a comprehensive understanding of competitors' market positions and strategies is crucial for identifying gaps, differentiating offerings, and formulating effective competitive strategies.

-

Resource Allocation: Market sizing data empowers businesses to optimize resource allocation, ensuring that investments are directed towards the most lucrative and promising market segments.

-

Goal Setting: Periodic market sizing analyses enable businesses to set realistic and achievable revenue goals, accounting for market fluctuations, industry trends, and evolving customer preferences.

By embracing market sizing as a strategic imperative, businesses can navigate the complexities of the market landscape with confidence, mitigating risks and capitalizing on emerging opportunities.

Top-Down Approach

The top-down approach to market sizing offers a macro-level view, starting with the broadest market definition and progressively narrowing it down to the specific segment of interest. This method is particularly useful when industry reports and aggregated data are readily available, providing a solid foundation for initial estimates.

The top-down process typically involves the following steps:

-

Define the Total Addressable Market (TAM): Begin by identifying the total economic activity or market value related to the product or service in question. This encompasses the broadest potential market, regardless of operational constraints or competitive barriers.

-

Narrow the Focus: Progressively refine the market definition by applying successive filters based on factors such as geographic regions, customer demographics, product categories, or distribution channels. Each refinement narrows the scope to a more specific subset of the larger market.

-

Estimate the Serviceable Addressable Market (SAM): After applying the relevant filters, arrive at an estimate of the market size for which your business can reasonably offer a compelling value proposition, considering factors like resources, capabilities, and target customer segments.

-

Identify Adjacent Markets: Explore adjacent markets or market segments that may present additional opportunities for expansion or diversification, further refining your understanding of the overall market landscape.

While the top-down approach offers a broad overview and facilitates the identification of potential market opportunities, it may lack granular accuracy as additional focusing assumptions are introduced. To mitigate this limitation, it is often complemented by the bottom-up approach, which provides a more granular and data-driven perspective.

Bottom-Up Approach

The bottom-up approach to market sizing takes a more granular and data-driven approach, starting with a specific market segment or customer base and building upwards to estimate the overall market potential. This method is particularly valuable when precise data is available or when targeting a niche market segment.

The bottom-up process typically involves the following steps:

-

Define the Beachhead Market: Identify the initial market segment or customer base that your business will target first. This beachhead market should offer the easiest access, allowing your business to gain traction, refine its offerings, and build scale.

-

Conduct Customer Research: Gather comprehensive data on potential customers within the beachhead market. This may involve interviews, surveys, or leveraging existing market research to understand customer needs, preferences, and purchasing behaviors.

-

Estimate Customer Spending: Based on the customer research, estimate the average spending or revenue potential per customer within the beachhead market. This can be achieved by analyzing factors such as purchase frequency, average order value, or subscription fees.

-

Count Customers: Literally count the number of potential customers within the beachhead market, leveraging databases, industry directories, or other relevant sources to create a comprehensive inventory of target customers.

-

Calculate the Beachhead Market Size: Multiply the estimated customer spending by the number of potential customers to arrive at a bottom-up estimate of the beachhead market size.

-

Explore Adjacent Markets: Identify and analyze adjacent markets or customer segments that share similar characteristics or needs with the beachhead market. By aggregating these adjacent markets, you can estimate the overall Serviceable Addressable Market (SAM).

The bottom-up approach offers a high degree of accuracy and granularity, particularly when estimating the market potential for niche segments or specific customer bases. However, it can be time-consuming and resource-intensive, as it requires extensive data collection and analysis.

Hybrid Approach: Combining Perspectives

In many cases, a hybrid approach that combines elements of both top-down and bottom-up methodologies can yield the most comprehensive and accurate market sizing estimates. By leveraging the strengths of each approach, businesses can navigate the complexities of market analysis with greater confidence and precision.

The hybrid approach typically involves the following steps:

-

Conduct Top-Down Analysis: Begin by performing a top-down analysis to establish a broad understanding of the overall market landscape, industry trends, and potential opportunities.

-

Identify Promising Segments: Based on the top-down analysis, identify specific market segments or customer bases that show promise and align with your business objectives.

-

Perform Bottom-Up Analysis: For the identified promising segments, conduct a bottom-up analysis by gathering granular data, counting potential customers, and estimating customer spending or revenue potential.

-

Reconcile Estimates: Compare and reconcile the bottom-up estimates with the top-down analysis, ensuring that the overall market size estimates are consistent and aligned with industry data and trends.

-

Refine and Iterate: Continuously refine and iterate the market sizing process as new data becomes available or market conditions evolve, ensuring that your estimates remain relevant and actionable.

By combining the breadth of the top-down approach with the granularity of the bottom-up method, businesses can gain a comprehensive understanding of the market landscape, identify promising opportunities, and make informed strategic decisions.

Leveraging Adjacencies and Complementary Markets

While market sizing often focuses on the core product or service offering, it is equally important to consider adjacencies and complementary markets. These related markets can present valuable opportunities for expansion, diversification, or the development of complementary offerings, enhancing the overall value proposition and market reach.

Adjacencies can take various forms, including:

-

Geographic Adjacencies: Exploring new geographic regions or markets beyond the initial target area, leveraging existing expertise and capabilities.

-

Product or Service Adjacencies: Identifying complementary products or services that can be offered alongside the core offering, creating a more comprehensive solution for customers.

-

Customer Segment Adjacencies: Exploring adjacent customer segments that share similar needs or characteristics with the primary target market, enabling cross-selling or upselling opportunities.

-

Technology Adjacencies: Leveraging existing technological capabilities or expertise to develop innovative solutions for adjacent markets or industries.

By carefully analyzing and incorporating adjacencies into the market sizing process, businesses can uncover new revenue streams, diversify their offerings, and strengthen their competitive position within the broader market landscape.

Accounting for Market Dynamics and Trends

Markets are inherently dynamic, shaped by a multitude of factors such as technological advancements, regulatory changes, economic conditions, and evolving consumer preferences. To ensure accurate and actionable market sizing estimates, it is crucial to account for these market dynamics and trends proactively.

Some key considerations include:

-

Technological Disruption: Emerging technologies can disrupt existing markets, creating new opportunities or rendering certain products or services obsolete. Staying ahead of technological trends is essential for anticipating market shifts and adapting strategies accordingly.

-

Regulatory Landscape: Changes in regulations, policies, or industry standards can significantly impact market dynamics, creating barriers or opening new avenues for growth. Monitoring regulatory developments is crucial for assessing their potential impact on market size and adjusting estimates accordingly.

-

Economic Factors: Macroeconomic conditions, such as economic growth, inflation, and consumer spending patterns, can influence market demand and purchasing power. Incorporating economic forecasts and projections into market sizing analyses can provide a more realistic and forward-looking perspective.

-

Consumer Behavior and Preferences: Evolving consumer preferences, lifestyle changes, and demographic shifts can reshape market demand and create new opportunities. Continuously monitoring consumer trends and adapting offerings to align with these shifts is essential for maintaining market relevance.

By proactively accounting for market dynamics and trends, businesses can enhance the accuracy and longevity of their market sizing estimates, enabling them to stay ahead of the curve and capitalize on emerging opportunities.

Competitive Landscape and Market Share Analysis

While market sizing provides insights into the overall market potential, it is equally crucial to understand the competitive landscape and assess your business's potential market share. This analysis not only informs strategic decision-making but also helps set realistic expectations and goals.

Competitive landscape analysis typically involves the following steps:

-

Identify Key Competitors: Conduct a thorough analysis to identify the major players in the market, including direct competitors, indirect competitors, and potential new entrants.

-

Assess Competitive Strengths and Weaknesses: Evaluate the strengths, weaknesses, and unique value propositions of each competitor, considering factors such as product offerings, pricing strategies, market positioning, and customer loyalty.

-

Analyze Market Share Distribution: Estimate the current market share distribution among the identified competitors, leveraging industry reports, market research, or publicly available data.

-

Identify Gaps and Opportunities: Analyze the competitive landscape to identify potential gaps, unmet customer needs, or underserved market segments that your business can target.

-

Estimate Realistic Market Share Potential: Based on your competitive analysis and unique value proposition, estimate the realistic market share your business can capture within a specific timeframe, considering factors such as marketing strategies, product differentiation, and customer acquisition efforts.

By integrating competitive landscape analysis with market sizing, businesses can develop a comprehensive understanding of their competitive positioning, identify opportunities for differentiation, and set achievable goals for market penetration and growth.

Resource Allocation and Strategic Planning

Market sizing is not merely an academic exercise; it is a critical input for resource allocation and strategic planning decisions. By understanding the market potential and competitive dynamics, businesses can make informed choices about where to allocate their resources, prioritize investments, and develop effective strategies for growth and profitability.

Resource allocation considerations may include:

-

Product Development: Based on market size estimates and customer preferences, businesses can prioritize product development efforts, allocating resources to the most promising and lucrative product lines or features.

-

Marketing and Sales Strategies: Market sizing data can inform the development of targeted marketing and sales strategies, ensuring that efforts are focused on the most promising customer segments and channels.

-

Operational Capacity and Infrastructure: Understanding the market potential can guide decisions related to operational capacity, supply chain management, and infrastructure investments, ensuring that the business is equipped to meet anticipated demand.

-

Financial Planning and Forecasting: Accurate market size estimates are essential for financial planning and forecasting, enabling businesses to set realistic revenue targets, manage cash flows, and secure necessary funding or investments.

-

Talent Acquisition and Development: Market sizing can inform talent acquisition and development strategies, ensuring that the business has the necessary human resources and expertise to effectively serve the target market and execute its growth plans.

By integrating market sizing insights into the strategic planning process, businesses can optimize resource allocation, mitigate risks, and position themselves for long-term success in their respective markets.

Market Sizing for Startups: Challenges and Best Practices

While market sizing is crucial for businesses of all sizes, startups face unique challenges and considerations when estimating market potential. Limited resources, lack of historical data, and the inherent uncertainties of new ventures can make market sizing a daunting task. However, by adopting best practices and leveraging available tools and resources, startups can navigate these challenges and gain valuable insights to inform their growth strategies.

Challenges faced by startups in market sizing include:

-

Limited Access to Data: Startups often lack access to comprehensive industry reports, market research, or proprietary data sources, making it challenging to gather accurate and reliable market information.

-

Unproven Business Models: With innovative or disruptive business models, startups may lack historical data or comparable benchmarks, making it difficult to estimate market demand and customer behavior.

-

Rapidly Evolving Markets: Startups frequently operate in rapidly evolving markets, where trends, technologies, and consumer preferences can shift quickly, rendering market sizing estimates obsolete.

-

Resource Constraints: Limited financial and human resources can restrict startups' ability to conduct extensive market research or engage in comprehensive market sizing exercises.

To overcome these challenges, startups can adopt the following best practices:

-

Leverage Lean Startup Methodologies: Embrace lean startup principles, such as customer discovery, minimum viable products (MVPs), and iterative development, to gather real-world data and validate market assumptions.

-

Utilize Free and Low-Cost Resources: Explore free or low-cost resources, such as government data sources, open-source market research, and online communities, to gather relevant market information.

-

Collaborate and Network: Engage with industry experts, mentors, and potential customers to gain insights, validate assumptions, and refine market sizing estimates.

-

Focus on Niche Markets: Consider targeting niche markets or specific customer segments initially, as these may be easier to size accurately and provide a solid foundation for growth.

-

Continuously Iterate and Refine: Treat market sizing as an ongoing process, continuously iterating and refining estimates as new data becomes available or market conditions evolve.

By embracing these best practices and adopting a flexible and data-driven approach, startups can overcome the challenges of market sizing and gain valuable insights to inform their strategic decisions and maximize their chances of success.

Visualizing Market Size: Effective Communication Techniques

Effective communication is crucial when presenting market sizing insights to stakeholders, investors, or decision-makers. By leveraging visual aids and compelling storytelling techniques, businesses can convey complex market data in a clear and engaging manner, facilitating understanding and driving informed decision-making.

Some effective visualization techniques for market sizing include:

-

Nested Circle Diagrams (Onion Diagrams): These diagrams use concentric circles to represent the TAM, SAM, and SOM, with the area of each circle proportional to the respective market size. This visual representation provides a clear and intuitive depiction of the market sizing funnel.

-

Bar Charts and Histograms: Bar charts and histograms can effectively illustrate market size comparisons, trends over time, or the distribution of market segments, making it easier to identify opportunities and prioritize investments.

-

Geographic Maps: For businesses operating in multiple regions or targeting specific geographic markets, color-coded maps can visually represent market size data, allowing for easy identification of high-potential areas or market penetration levels.

-

Infographics and Data Visualizations: Well-designed infographics and data visualizations can combine various visual elements, such as charts, icons, and illustrations, to communicate market sizing insights in an engaging and memorable way.

-

Interactive Dashboards: Interactive dashboards can provide stakeholders with the ability to explore market sizing data dynamically, enabling them to drill down into specific segments, adjust assumptions, or visualize different scenarios.

Effective visualization techniques should be accompanied by compelling storytelling and clear explanations of the underlying assumptions, methodologies, and data sources. By combining visual aids with narratives that resonate with the audience, businesses can effectively communicate the strategic implications of their market sizing analyses, fostering buy-in and driving informed decision-making.

Continuous Monitoring and Adaptation

In today's rapidly evolving business landscape, market dynamics are in a constant state of flux. Consumer preferences, technological advancements, and competitive forces can quickly render market sizing estimates obsolete. To maintain a competitive edge and capitalize on emerging opportunities, businesses must embrace a mindset of continuous monitoring and adaptation.

Continuous monitoring involves proactively tracking and analyzing relevant market indicators, such as:

-

Consumer Trends: Closely monitoring consumer behavior, preferences, and feedback can provide valuable insights into evolving market demands and potential shifts in purchasing patterns.

-

Technological Advancements: Staying abreast of technological developments, both within and outside of your industry, can help identify potential disruptions, new market opportunities, or the need to adapt existing offerings.

-

Competitive Landscape: Regularly analyzing the strategies, product launches, and market positioning of competitors can help identify potential threats or opportunities for differentiation.

-

Regulatory and Policy Changes: Monitoring regulatory and policy developments can help anticipate potential impacts on market dynamics, enabling businesses to proactively adapt their strategies and maintain compliance.

-

Economic and Demographic Shifts: Tracking macroeconomic indicators, demographic trends, and changes in consumer spending patterns can provide valuable insights into market demand and growth potential.

By continuously monitoring these factors, businesses can identify emerging trends and patterns, enabling them to adapt their market sizing estimates, refine their strategies, and seize new opportunities as they arise.

Adaptation, in this context, involves actively adjusting and refining market sizing approaches, assumptions, and strategic plans in response to the insights gained through continuous monitoring. This may involve:

-

Revising Market Size Estimates: As new data becomes available or market conditions change, businesses should be prepared to revisit and refine their market size estimates, ensuring they remain accurate and relevant.

-

Adjusting Product and Service Offerings: Based on evolving market demands and consumer preferences, businesses may need to adapt their product or service offerings, introducing new features, or pivoting to address emerging market segments.

-

Reallocating Resources: Continuous monitoring may reveal the need to reallocate resources, such as shifting investments toward high-potential market segments or divesting from underperforming areas.

-

Refining Go-to-Market Strategies: Changes in the competitive landscape or market dynamics may necessitate adjustments to marketing, sales, and distribution strategies to maintain a competitive edge.

-

Exploring New Market Opportunities: Continuous monitoring can uncover new market opportunities, prompting businesses to consider expanding into adjacent markets, exploring new geographic regions, or developing complementary offerings.

By embracing a culture of continuous monitoring and adaptation, businesses can stay ahead of the curve, respond proactively to market shifts, and position themselves for long-term success in an ever-changing business environment.

Integrating Market Sizing with Business Strategy

Market sizing is not an isolated activity; it is a critical component of a comprehensive business strategy. By integrating market sizing insights with other strategic planning processes, businesses can develop holistic and cohesive strategies that drive growth, profitability, and long-term success.

Some key areas where market sizing intersects with business strategy include:

-

Product and Service Development: Market sizing data can inform product and service development strategies, helping businesses prioritize investments in new offerings, features, or enhancements that align with market demand and customer preferences.

-

Marketing and Branding: Understanding market size, segmentation, and customer behavior can guide the development of targeted marketing and branding strategies, ensuring that messaging and campaigns resonate with the desired target audience.

-

Sales and Distribution: Market sizing insights can help businesses optimize their sales and distribution channels, ensuring that resources are allocated effectively to reach the most promising market segments and maximize revenue potential.

-

Operational Planning: Accurate market size estimates are essential for operational planning, allowing businesses to align their production capacity, supply chain management, and infrastructure investments with anticipated market demand.

-

Financial Planning and Investment Decisions: Market sizing data is a critical input for financial planning, budgeting, and investment decisions, enabling businesses to set realistic revenue targets, manage cash flows, and secure necessary funding or investments.

-

Competitive Strategy: By understanding the competitive landscape and market share distribution, businesses can develop effective competitive strategies, identifying opportunities for differentiation, positioning, and strategic partnerships or acquisitions.

-

Risk Management: Market sizing analyses can help businesses identify potential risks and challenges, such as market saturation, disruptive technologies, or regulatory changes, enabling them to proactively mitigate risks and develop contingency plans.

By integrating market sizing insights into the broader strategic planning process, businesses can ensure alignment between their market understanding, product and service offerings, operational capabilities, and overall business objectives. This holistic approach fosters a cohesive and data-driven strategy that maximizes the chances of success in the target market.

Future Outlook and Emerging Trends

As businesses navigate the ever-changing market landscape, it is essential to stay attuned to emerging trends and technologies that may impact market sizing approaches and methodologies. The future of market sizing is likely to be shaped by advancements in data analytics, artificial intelligence (AI), and the increasing availability of real-time market data.

-

Big Data and Advanced Analytics: The proliferation of data sources and the ability to process and analyze vast amounts of structured and unstructured data will enable more sophisticated market sizing techniques. Businesses can leverage advanced analytics tools to uncover hidden patterns, correlations, and insights that can enhance the accuracy and granularity of market size estimates.

-

Artificial Intelligence and Machine Learning: AI and machine learning algorithms can be leveraged to automate and streamline various aspects of the market sizing process. From identifying potential customers and segmenting markets to forecasting demand and optimizing resource allocation, AI-powered solutions can enhance efficiency and decision-making capabilities.

-

Real-Time Market Intelligence: With the advent of the Internet of Things (IoT), social media, and other digital platforms, businesses can access real-time market intelligence, monitoring consumer behavior, sentiment, and trends as they unfold. This real-time data can be integrated into market sizing models, enabling businesses to adapt quickly to changing market conditions.

-

Crowdsourcing and Collaborative Platforms: Collaborative platforms and crowdsourcing techniques can be leveraged to gather market insights and validate assumptions from a diverse pool of experts, industry professionals, and potential customers, enhancing the accuracy and relevance of market sizing estimates.

-

Virtual and Augmented Reality: As virtual and augmented reality technologies advance, businesses may explore their potential applications in market sizing and customer research. Immersive experiences and simulations can provide valuable insights into consumer behavior, preferences, and decision-making processes, informing market sizing strategies.

-

Integration with Strategic Planning Tools: Market sizing tools and methodologies are likely to become more tightly integrated with broader strategic planning platforms and decision support systems, enabling businesses to seamlessly incorporate market insights into their overall strategic planning processes.

By staying attuned to these emerging trends and embracing innovative technologies, businesses can enhance the accuracy, efficiency, and agility of their market sizing approaches, positioning themselves for success in an increasingly dynamic and competitive market environment.

Conclusion

Mastering market sizing approaches is an indispensable skill for entrepreneurs, investors, and strategic decision-makers alike. By combining top-down and bottom-up methodologies, leveraging adjacencies, and accounting for market dynamics, businesses can gain a comprehensive understanding of their market potential and position themselves for sustainable growth. Additionally, integrating market sizing insights with broader business strategies, continuously monitoring market shifts, and embracing emerging technologies will enable businesses to navigate the complexities of the market landscape with confidence and agility. As the business world continues to evolve, the art of market sizing will remain a critical component of strategic planning, driving informed decision-making and fostering long-term success.

Subscribe to our newsletter to get latest news in your inbox.

© 2025 Aurora. All Rights Reserved